Tether (USDT) – самый крупный стейблкоин. Как им пользоваться?

Description

Tether является самым популярным и первым стейблкоином, стоимость которого базируется на стоимости доллара США. В данной статье мы подробно рассмотрим: в чём его преимущества и недостатки, почему его стоит использовать как замену уходящему Perfect Money, какие протоколы бывают и разберём несколько примеров по работе с ним.

Что такое Tether USDT. Преимущества и недостатки

Tether (USDT) – является четвёртой по капитализации и первой по объему торгов криптовалютой в мире (на момент написания данной статьи), курс которой всегда стабилен благодаря привязке к доллару США.

1 USDT = 1$.

Преимущества:

- Резервы фиата. Компания Tether заявляет, что валюты платформы на 100% обеспечены резервами. Это означает, что все желающие могут перевести все свои USDT в USD и всем хватит фиатных денег. Правда, здесь есть нюанс: в реальности Tether обеспечена на 74%, значительная часть которых – это ценные бумаги и займы, выданные родственным компаниям. Тем не менее у Bitcoin или Ethereum нет никаких резервов, поэтому, по факту, USDT более надёжен, чем BTC или ETH.

- Уровень принятия. Криптоинвесторы используют USDT в качестве «тихой гавани». При помощи Tether можно зафиксировать профит с продажи криптовалюты или осуществить быструю покупку с минимальной комиссией.

- Дешёвые и быстрые транзакции. Платформа Tether интегрирована с боковой цепочкой OMG Network Plasma (OMG) блокчейна Ethereum. Сеть Tether на базе OMG доступна через биржу Bitfinex, трейдеры которой теперь смогут быстрее реагировать на изменения на рынке и сэкономить на торговых комиссиях.

- Капитализация. На момент написания статьи криптовалюта Tether находится на четвёртой строчке по рыночной капитализации.

Недостатки:

- Централизация. Анализ транзакций стейблкоина показал, что бо́льшая часть токенов сконцентрирована на 100 кошельках, что создаёт риски манипуляции курсом монет. По мнению экспертов, компания именно это и делает, о чём мы напишем ниже.

- Непрозрачность. На сайте криптовалюты написано, что 100% «токенов обеспечены резервами». Однако после того как Комиссия по торговле товарными фьючерсами прислала Tether Limited повестку в суд из-за сомнений в правдивости указанного утверждения, компания заявила, что обеспечение составляет лишь 74% и часть обеспечения – это ценные бумаги и деньги, взятые в кредит. При этом компания отказывается от проверки этих цифр независимым аудитором.

- Репутационные проблемы. В сети можно найти различную информацию о скрытие реального состояния резервов, а также манипулированием курса Bitcoin совместно с Binance. Благодаря этим манипуляциям создаются ложные объемы торгов, благодаря которым USDT находится на первом месте среди всех криптовалют по данному параметру. В том числе выше Bitcoin.

Почему стоит использовать Tether

Использование Tether выгодно как для отдельных трейдеров, так и для бирж, а на фоне прекращения работы Perfect Money с хайп-проектами еще и для хайп-индустрии. Пока Tether является одной из лучших альтернатив ушедшей платёжной системы.

Как уже было сказано в преимуществах, Tether является стабильным токеном с фиксированным курсом 1:1, то есть 1 USDT = 1$. Tether ведёт прозрачную ежедневную отчётность, которая позволит вам убедиться в том, что весь оборот USDT соответствуют резерву.

Tether позволяет трейдерам использовать монету для ходла (удержания криптовалюты вне зависимости от рыночной цены) не беспокоясь о волатильности. В случае с хайпами, опять же здесь большой плюс, которым можно воспользоваться. Тот же доллар, только в криптовалюте. Когда рынок становится медвежьим, то с помощью этого стейблокоина вы можете защитить свои цифровые активы от внезапных ценовых скачков и обезопасить себя от убытков.

Протоколы Tether

Первым коротко разберём открытый протокол OMNI, который является надстройкой над блокчейном Bitcoin. Платформа OMNI позволяет создавать цифровые активы, смарт-контракты и децентрализованные Peer-to-peer биржи.

Использование сети Bitcoin даёт протоколу OMNI ряд преимуществ, среди которых защищенность и устойчивость сети Bitcoin. Выпущенные монеты в данной сети позволяют использовать их в кошельках, которые поддерживают Bitcoin. Tether входит в их число.

Наверное, самым главным разочарованием Tether OMNI будет соответствующие Bitcoin высокие комиссии. В среднем время транзакции занимает около 10 минут.

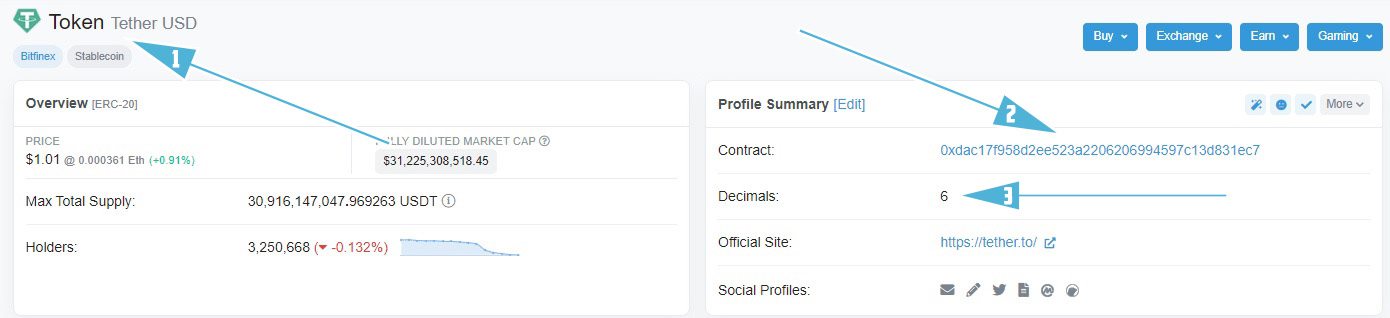

Далее разберём протокол на базе Ethereum, который имеет приставку ERC-20. Данный протокол позволяет использовать Tether в смарт-контрактах и децентрализованных приложениях, работающих на базе Ethereum.

Главным преимуществом ERC-20 является более лучшее время транзакции, которое составляет в среднем 15 секунд, вместо 10 минут в сети Bitcoin. Стоит отметить, что в сети Ethereum еще меньший размер комиссий.

Еще есть Tether BEP-2 (блокчейн Binance) и Tether BEP-20 (BSC – смарт цепочка Binance) на основе умной сети Binance, комиссии за перевод минимальны. Обратите внимание, что BEP-20 и ERC-20 имеют одинаковый формат адреса. Данный протокол не предназначен для конкуренции с Ethereum или замены ETH. BSC – это просто ETH-совместимая цепочка, которая предназначена для предоставления пользователям дополнительных возможностей, таких как быстрое время блока (скорость транзакций), низкие комиссии и т. д.

Сейчас уже постепенно подключают данный протокол Tether'а к хайпам, поэтому не исключаем, что он будет популяризироваться.

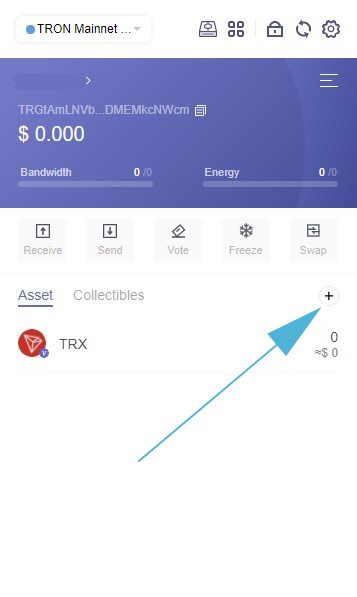

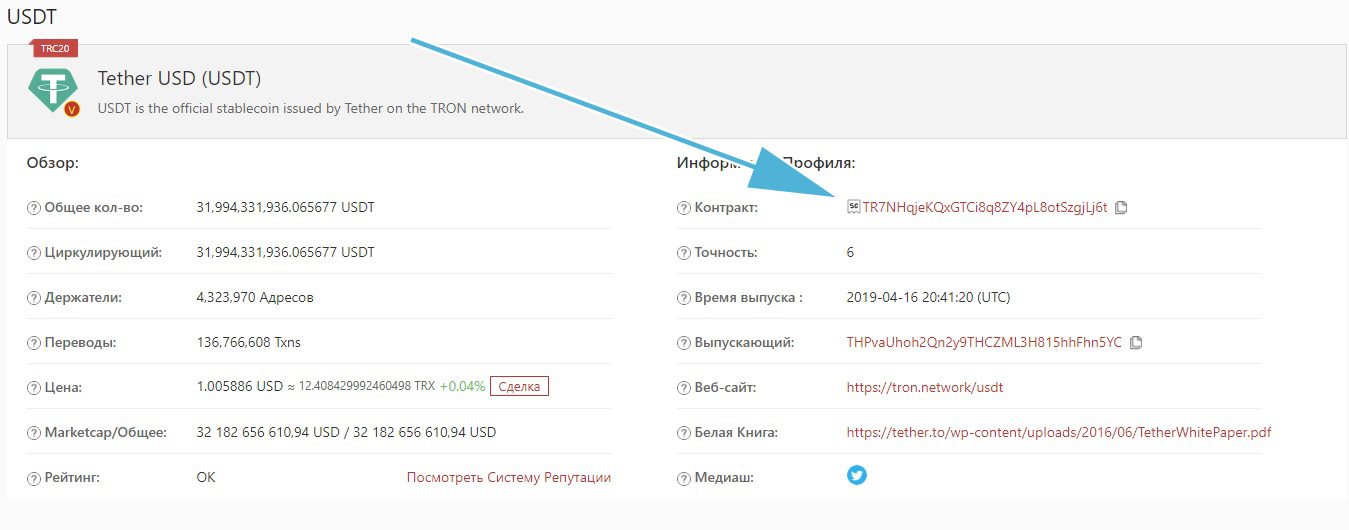

Напоследок перейдём к протоколу TRC-20, который базируется на TRON. Tether, используемый на основе TRON, имеет наиболее высокую скорость транзакций среди всех протоколов, что является огромным преимуществом. Рекомендуем в большинстве случаев использовать именно Tether TRC-20.

Изначально стейблкоины запущенны на основе TRC-20 использовались для реализации токенов, аналогичным и совместимым со стандартом Ethereum ERC-20. Добавление монеты на блокчейне Tron задумывалось для развития экосистемы децентрализованных приложений (dApps) TRON.

Криптовалюта выпущенная в различных сетях абсолютно равнозначна. Различаются только протоколы её выпуска, времени которое занимает одна транзакция и комиссии, которые берутся внутри той или иной сети. Мы рекомендуем использовать сеть TRC-20.

Обратите внимание, что при переводе очень важно, чтобы сети совпадали (OMNI, ERC-20, TRC-20). В противном случае вы потеряете свои деньги.

Инструкции по работе с Tether

Прежде всего стоит отметить, что существует несколько способов покупки Tether:

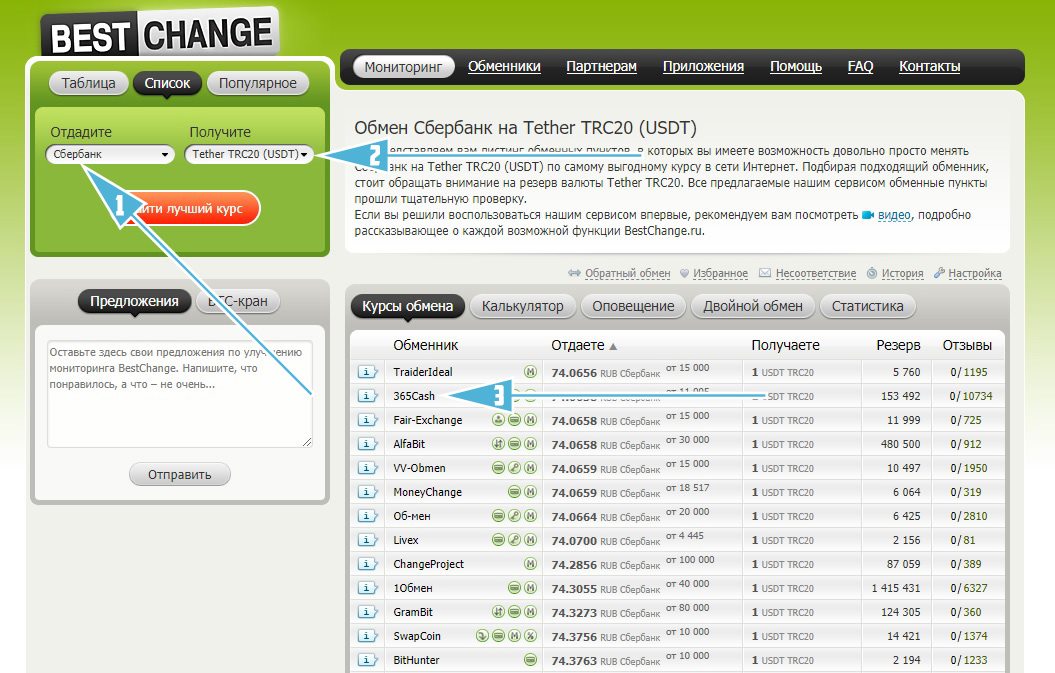

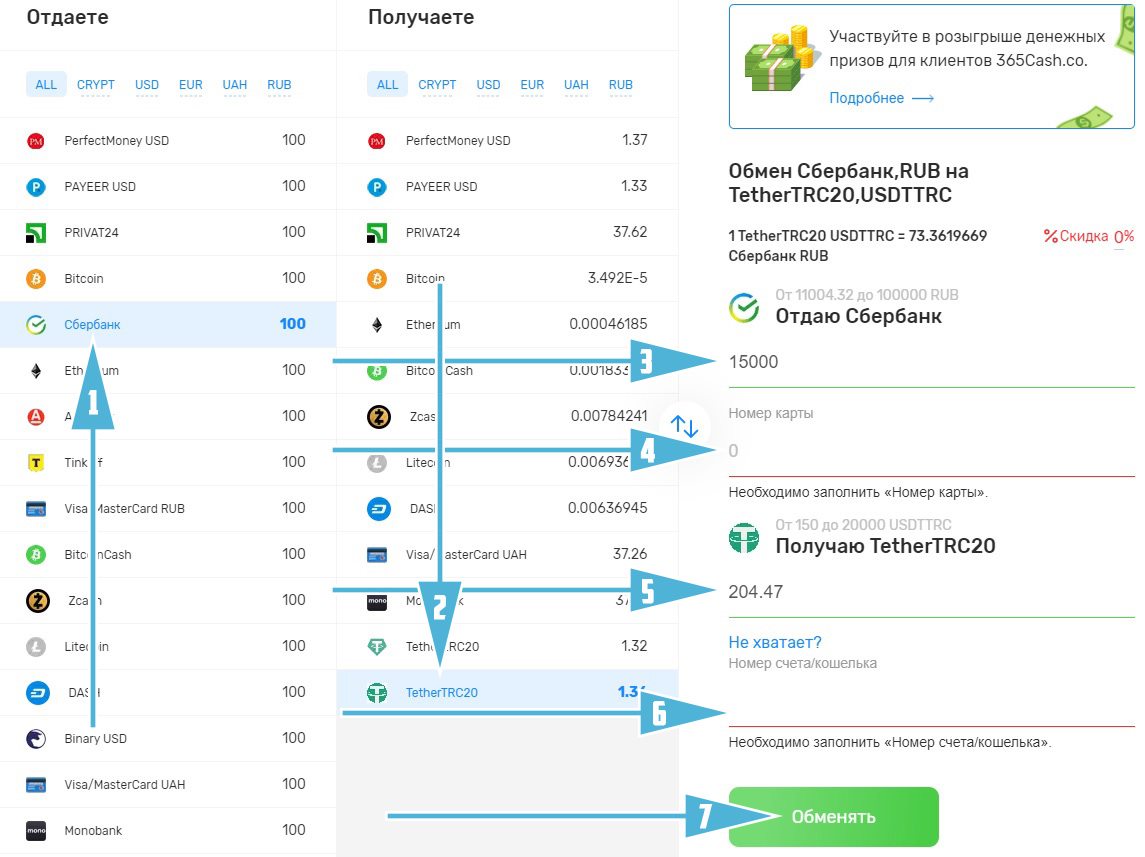

- Обменники. Наверное, самым простым способом можно отметить именно обменники, т.к. вам всего лишь нужно выбрать направление обмена, заполнить форму и выполнить операцию. Напомним, что лучше всего воспользоваться мониторингом-обменников Bestchange.ru и выбрать подходящий вам обменник. Обращайте внимание, что минимальная сумма обмена не всегда может соответствовать вашей;

- Биржи. Нельзя сказать, что на биржах купить Tether сложно. С большой вероятностью на используемой вами бирже будет присутствовать один или большинство протоколов USDT. Для покупки рекомендуем воспользоваться биржей Binance.com;

- Официальный сайт Tether. Еще есть вариант воспользоваться официальным сайтом компании tether.to, но поспешим сказать, что сделать это не так просто и необходимо пройти верификацию.

Мы уже писали об этом, но стоит упомянуть еще раз, что при покупке USDT необходимо обращать внимание на сеть и формат адреса. В случае, если вы, например, отправите Tether OMNI на Tether TRC-20, рискуете потерять свои денежные средства.

Выше мы разобрали самые популярные способы где можно хранить Tether, но есть и другие варианты:

- Кошельки для Tether OMNI: omniwallet.org, omnilayer.org, guarda.com, trusteeglobal.com;

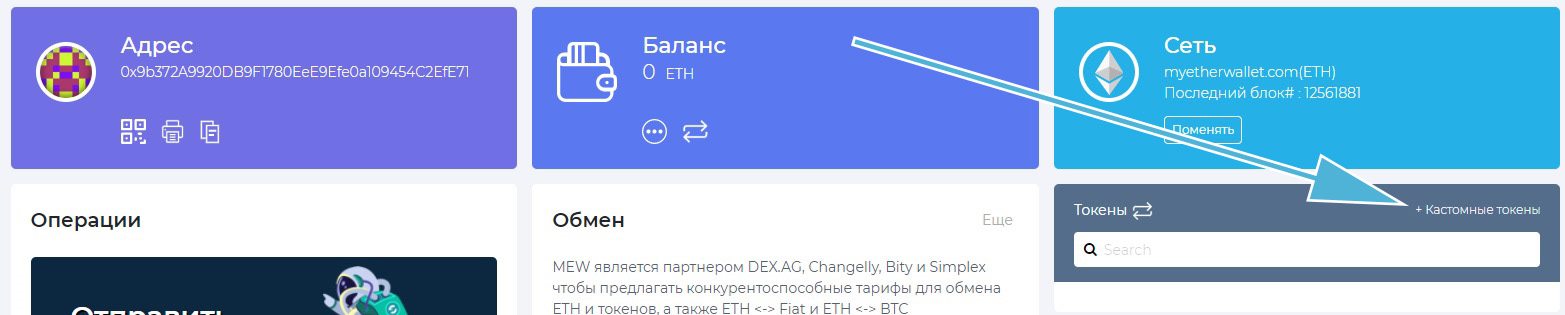

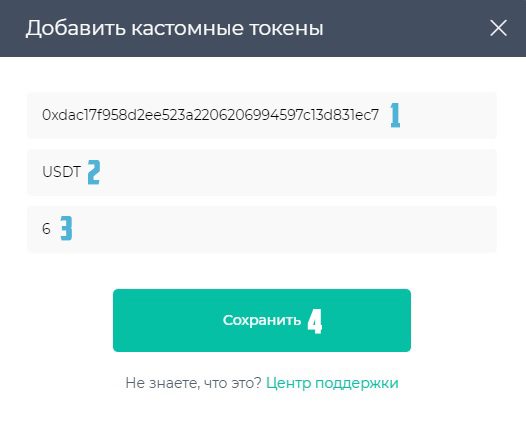

- Кошельки для Tether ERC-20: metamask.io, guarda.com, trustwallet.com, blockchain.com, trusteeglobal.com;

- Кошельки для Tether BEP-2: Расширение Binance Chain Wallet, Binance DEX Wallet, coinomi.com, trustwallet.com, mathwallet.org;

- Кошельки для Tether BEP-20: Расширение Binance Chain Wallet, trustwallet.com, mathwallet.org;

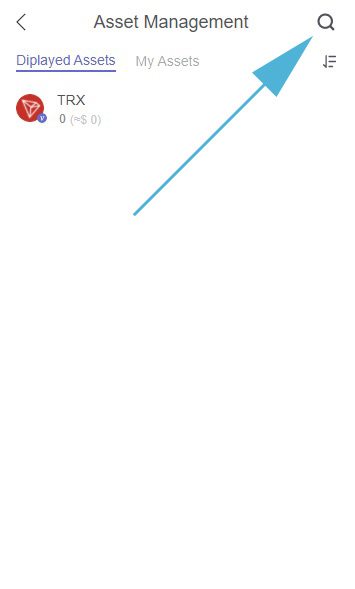

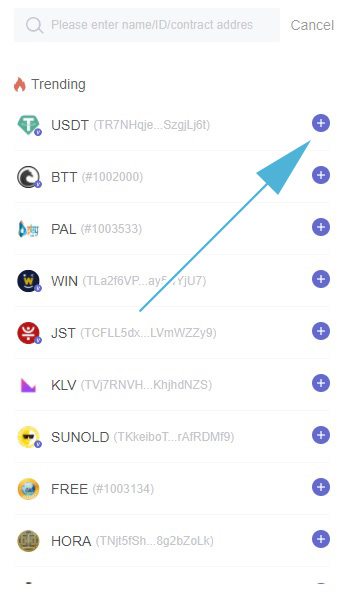

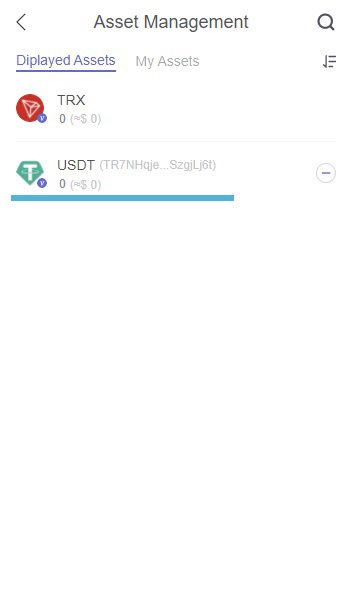

- Кошельки для Tether TRC-20: tronlink.org, token.im, mathwallet.org, guarda.com, trustwallet.com, trusteeglobal.com, klever.io;

- Аппаратные кошельки: Ledger, Trezor, Safepal.

Заключение

На данный момент Tether является одной из самых известных криптовалют. Используя USDT трейдеры или инвесторы могут хранить деньги в активах, которые привязаны к доллару, без лишних издержек по транзакциям при конвертации в криптовалюту или обратно.

Сейчас можно со смелостью сказать, что это хорошая альтернатива в хайпах в связи с возможным уходом из индустрии платёжной системы Perfect Money.

Tether можно использовать как для торговли криптовалют и уже для работы с хайпами. Постепенно данная криптовалюта внедряется в проекты и мы надеемся, что многие админы будут её подключать.

Выгоднее всего будет использовать Tether TRC-20 в виде относительно других протоколов небольших комиссий и скорости транзакций.

Считаем, что сейчас самое время всем начинать пользоваться криптовалютой и разбираться во всех тонкостях. Возможно в будущем появятся другие платёжные системы на замену Perfect Money. Например, NixMoney, которая раньше использовалась, либо всё-таки PM поменяет свои условия по работе с хайпами, т.к. увидят большой отток средств. Еще есть вариант, что админы найдут пути обхода комиссий, так как в Antares Trade принимает платежи при помощи стороннего мерчанта.

В данной статье мы разобрали: криптовалюту Tether, её преимущества и недостатки, почему стоит начать ей пользоваться, разобрали на каких протоколах работает криптовалюта Tether, а также привели небольшие примеры по работе с монетой.

Напишите в комментариях какими кошельками вы пользуетесь и считаете удобными для ПК или мобильных устройств, возможно были какие либо проблемы с определенными кошельками. У кого будут сложности в покупке или продаже, вопросы по созданию кошельков, можете писать по контактам, которые предоставлены ниже. Обязательно вам поможем и проконсультируем!

Надеемся, что статья была для вас полезна. Всем удачных и прибыльных инвестиций!

Information

Users of Гости are not allowed to comment this publication.

Comments (38)